Call Us First

Don’t Overpay for your home loan

We shop for the best loan and financial assistance programs at the lowest rates and fees. We work for you, NOT the lender. If you already have a lender, we will gladly compare our loan programs, rates, and fees versus your lender. Satisfaction Guaranteed or Your Money Back. For details on loan options, click on the box below.

Purchase

- Zero down payment to $650k, min. 720 FICO

- Zero down payment to $850k or 5% down to $1 mil for professionals

- VA zero down payment

- USDA zero down payment, Rural properties only

- 1% down payment to $510k for nurses, firefighters, law enforcement

- 3% down payment to $850k loan amount, 18% PMI

- 3% down payment Fannie Mae HomeReady program, 640 min FICO

- 50% down payment FHA

- 5% down payment to $1.25 mil for doctors, min. 720 FICO

- 10% down payment to $1.50 mil for doctors, min 720 FICO

- 15% down payment to $2 mil. loan amount, no PMI

- Conventional conforming to $510,750

- High balance to $765,500

- Jumbo $765,500+

Refinance & Cash-out

- Conforming $510,750 to 98% LTV

- High balance $765,500 to 90% LTV

- Jumbo to 80% LTV

- Fixed rate, 30, 20 & 15 years

- Adjustable Rate 10/1, 7/1, 5/1 & 3/1

- FHA

- VA

- USDA

- Cash-out to 80% LTV

- Loan amounts to $5 million

First-Time Home Buyer

- 284 Financial assistance programs in California

- Down payment assistance programs

- 3% down payment to $800k for school staff to $700k loan

- See Purchases box for more programs

Investment Properties

- 80% maximum LTV, purchase and refinance

- 1-4 units

- 75% LTV better rates

- 20 properties max

- Cash-out to 70% to $650k loan

- 2nd loan fixed rate & Home Equity Lines of Credit (HELOC) ARM

Self-Employed

- 60% debt-to-income ratio

- $3.5 million maximum loan amount

- 85% CLTV maximum

- 1 year tax return

Bank Statement

- 3, 6, 12 & 24 months bank statement programs

- 12 months bank statements to 80 LTV, $2.5 mil max, 660 min FICO

- 24 months bank statements to 85 LTV, $3 mil max, 660 min FICO

- 24 months bank statements to 75 LTV, $2.5 mil max, 640 min FICO

- 70% blended bank statement and tax returns, 680 FICO to $2 Mil

- Investment to 70 LTV, $3 Mil max, 680 min FICO

- Investment to 60 LTV, $2 mil max, 720 min FICO

- Second Home, 60% LTV max

- Purchase, refinance & cash-out refinance

- Call for more details

Reverse Mortgage

- Purchase up to $40 million

- Refinance to lower rate

- Refinance to get cash-out

Seconds – Fixed Rate & Home Equity Line of Credit

- 95% CLTV max HELOC

- Investment property HELOC to 80% LTV, 660 min credit score

- Fixed rate for 5, 10 & 20 years, interest only or P&I payment

- Purchase 2nds

Mobile/Manufacture Home

- Leased or own the land

- 5% min down payment, 660 FICO,

- Purchase, refinance or cash-out refinance

- $20,000 minimum loan amounts

- 500 Min FICO, 35% down payment

- 620 Min FICO, 25% down payment

Lot & Construction-to-perm

- Lot only purchase

- 20% Min. down payment on improved land lot purchase

- 25% Min. down payment on unimproved land lot purchase

- 680 Min FICO

- Loan amounts to $1 mil, 50% LTV

- Construction-to-perm loan programs

- 20% Min down payment to $1.5 mil

- Loan amounts to $6.5 mil, 65% LTV

Hard Money / Fix & Flip

- Owner occupied refinance & cash-out, if for business purpose

- Investment property refinance & cash-out

- Fix & Flip, 6-24 months, 85% max LTV purchase

- Fix & Flip, 6-24 months, 70-75% max LTV as is value

Mixed Use

- Houses on acres of land

Co-op

- No min. loan amount

- 80% max. LTV

- 30 year fixed rate,

- 620 mi. FICO score

- No mortgage insurance

Other Loan Programs

- ITIN (individual Tax Identification Number) to 80% LTV, 700 FICO

- Debt service programs

- No tax returns program

- Asset only loan program

- 1 Yr Tax Return Program up to 85 LTV – $2.5MM Max / 660 Min Fico

- Multi-family to 80% LTV

- Foreign national program

- Interest only loan payments

- Lender purchases home quickly for buyer before other buyers, then complete loan with lender at a later date within 90 days

- All In loan program provides access to home equity and pays-off loan sooner for cash-flow positive borrowers

Testimonial

“I had a great experience! I was already working with another mortgage company when I was introduced to Dan. He was quickly able to beat the deal I was already prepared to sign with. Saved me .75% plus cash towards my closing costs. Was with me every step of the way, I never felt lost or left in the dark. Amazing experience for buying my first home. Highly recommended!”

-Thomas K.

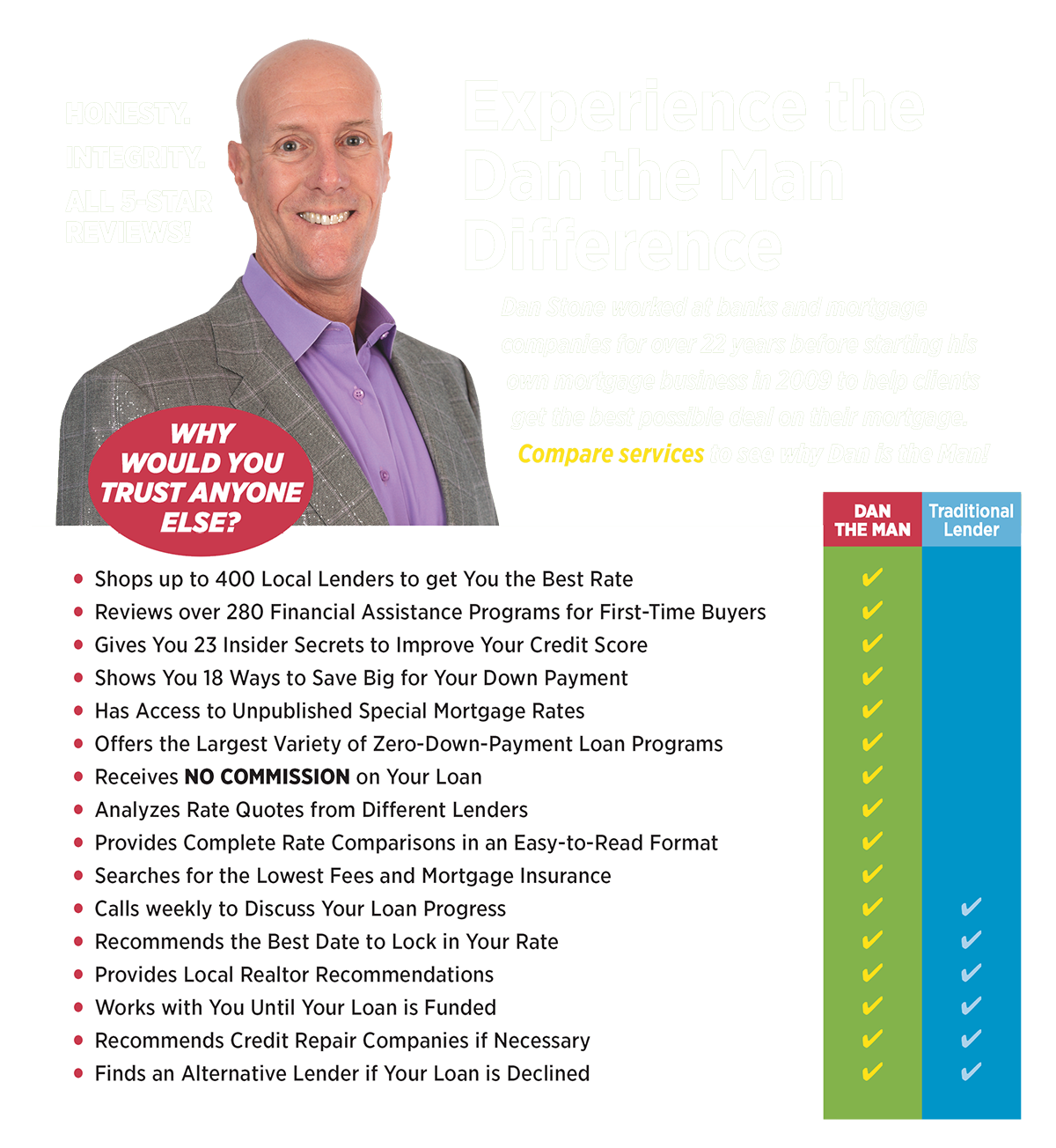

Honesty & Integrity

YOU deserve to receive the most accurate and complete information. Our business is built on being honest with everyone and provide the highest level of integrity. The mortgage industry is fraught with salesman and companies trying to take advantage of borrowers all in an effort to earn a commission and profit. We aim to fix it, one borrower at a time.

Innovative

1,000’s of lenders trying to fit you into their loan program and rates, then earn a profit. Our unique mortgage service provides each borrower 100 times more options than any single lender and for a better deal.

Best Success

Read our success stories. Our goal is to save you the most amount of money versus any lender you may be considering. We have helped borrowers save $1,000/mo versus the lender they planned to use or helped a borrower get a loan when all other lenders said no.

CONTACT US

Dan@DantheManforMortgages.com